Top 5 Most Traded Currency Pairs

Introduction

Tracing its origins back hundreds of years ago, in the modern age, the forex market is not only the most volatile but also the largest in terms of market trading volume, meaning speculating on its price movements can prove lucrative for traders.

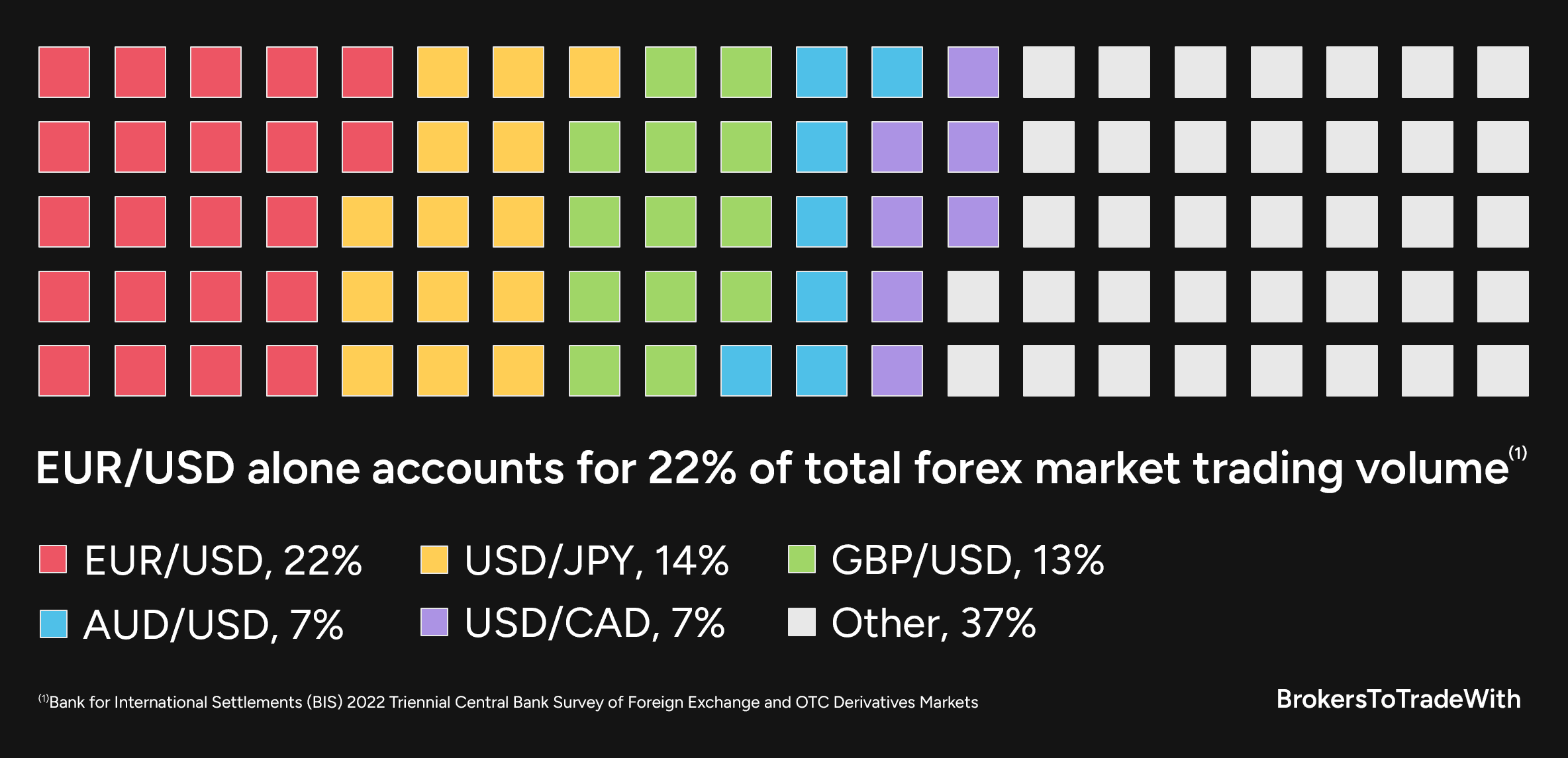

In this article, we highlight the five most-traded currency pairs according to their daily trading volume¹.

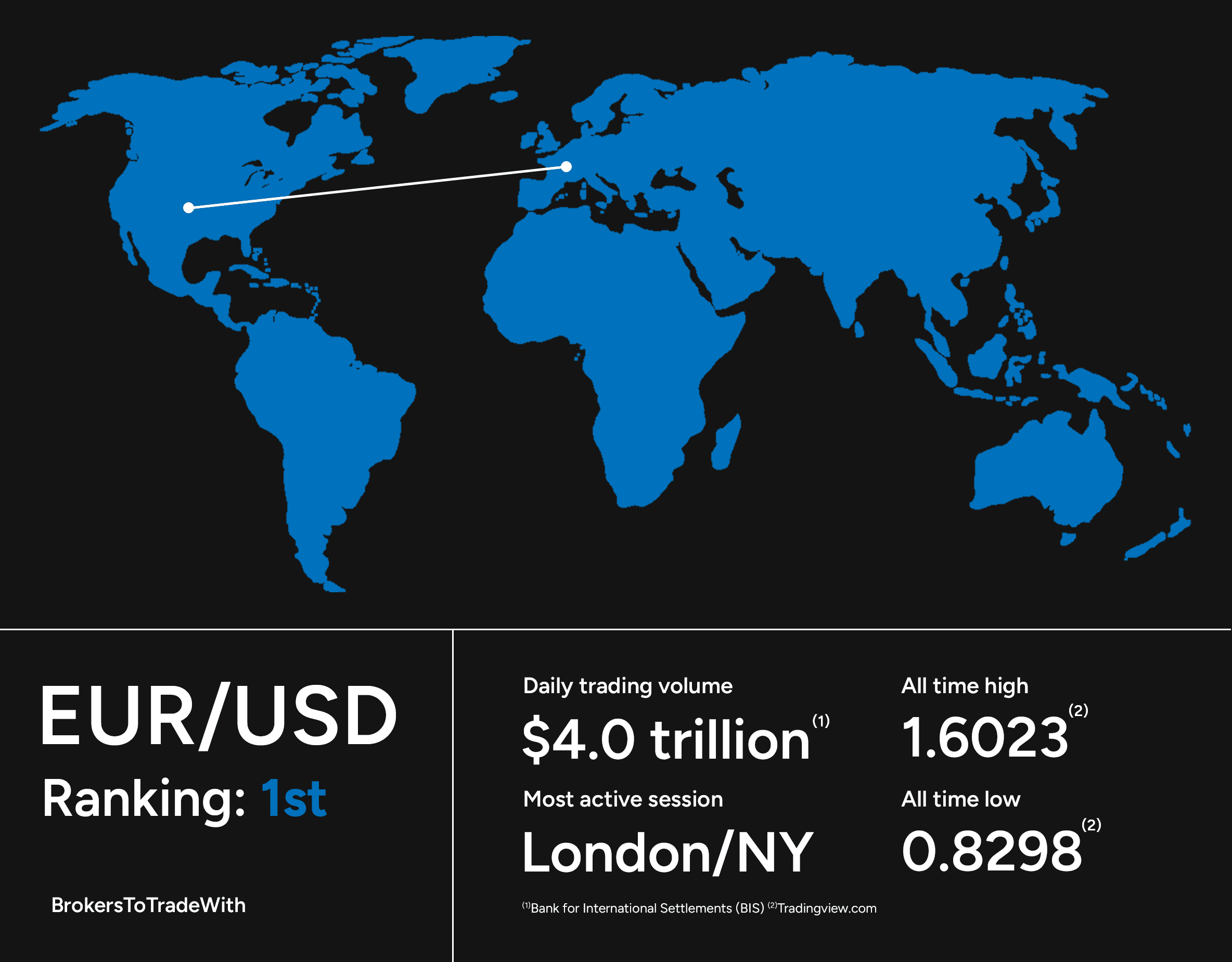

1. EUR/USD

As a surprise to a few, EUR/USD reigns supreme as the most traded currency pair globally, accounting for almost a quarter of forex market trading volume¹.

This level of popularity poses many benefits for traders, including:

- High volatility, especially during the London and New York sessions

- High liquidity, meaning spreads are often tighter

For those wanting to trade the ‘fiber’, key data releases from both the U.S. Federal Reserve and European Central Bank should be taken into consideration, especially when seeking trading opportunities.

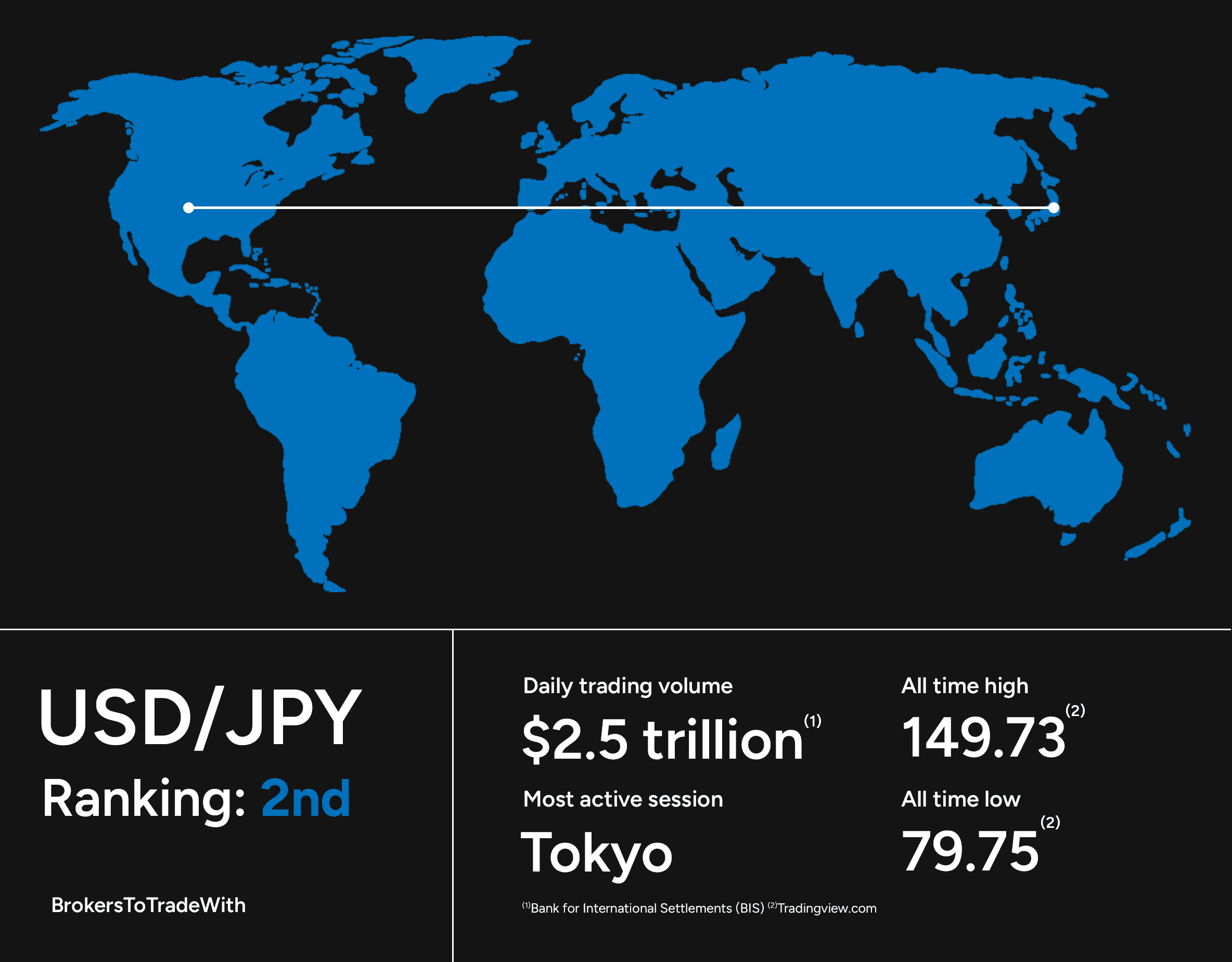

2. USD/JPY

Although in a distant second, USD/JPY still accounts for a staggering $2.5 trillion in daily trading volume, higher than the GDP of Canada, Spain, and Brazil, respectively².

Unique amongst its peers for notable popularity in the Tokyo session, the Japanese yen and U.S. dollar are not only the chosen currencies of two of the world’s largest economies but also the most-traded currencies of their regions: North America and Asia, respectively.

By virtue, USD/JPY boasts a high level of volatility and liquidity, which can prove fruitful for those looking to profit from speculating on price movements.

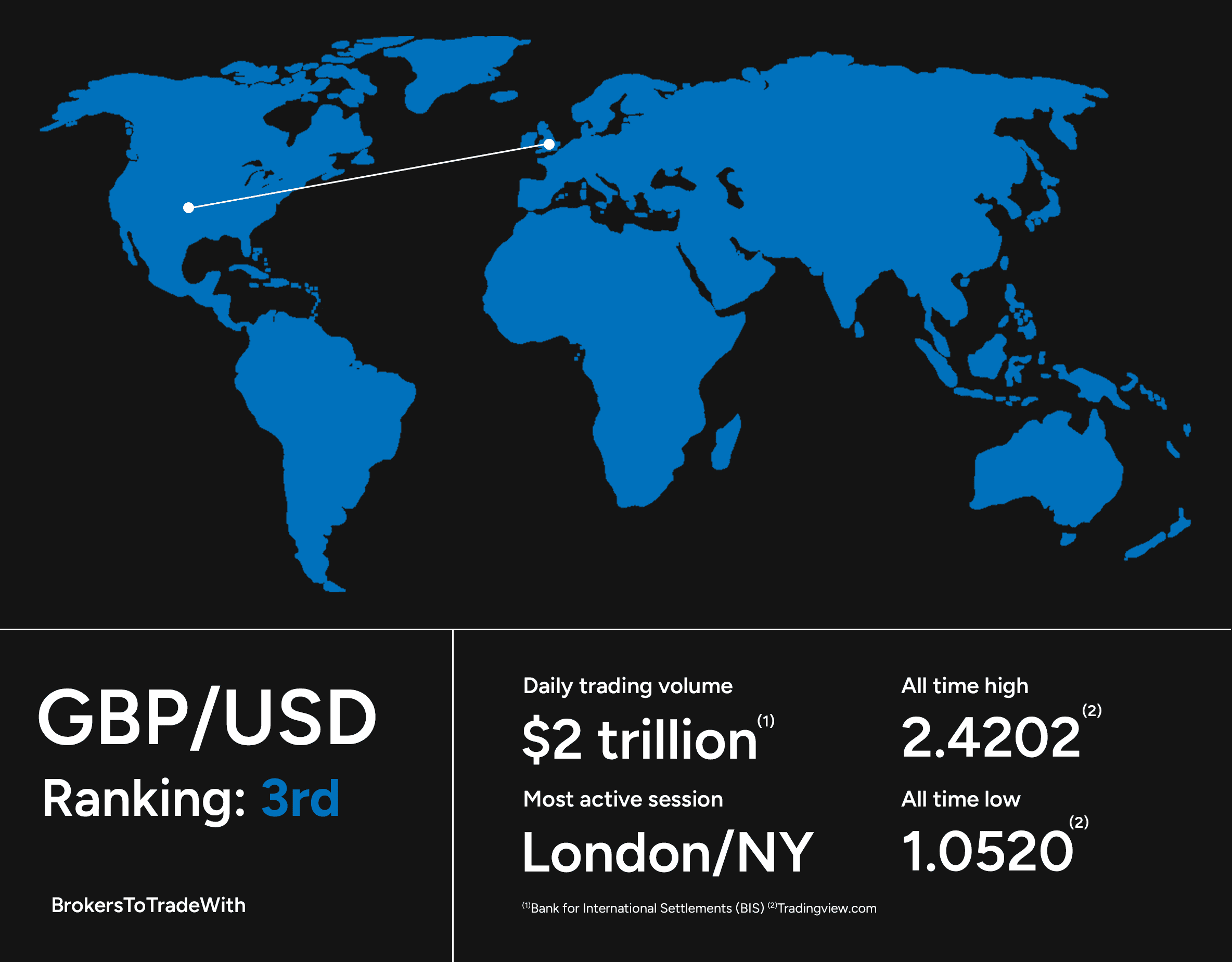

3. GBP/USD

Following closely in third place, GBP/USD alone accounts for 13% of total trading volume within the FX market¹.

Colloquially known as the ‘cable’, owing to the transatlantic deep-sea cables that once connected New York and London currency exchanges, GBP/USD is world-renowned for its multiple spikes of trading activity, including the openings of the London and New York sessions as well as some during the Sydney.

Traders would be well advised to consider the actions of both the Bank of England (BoE) and U.S. Federal Reserve when seeking opportunities to trade GBP/USD, alongside other market-moving events such as nonfarm payrolls and CPI reports.

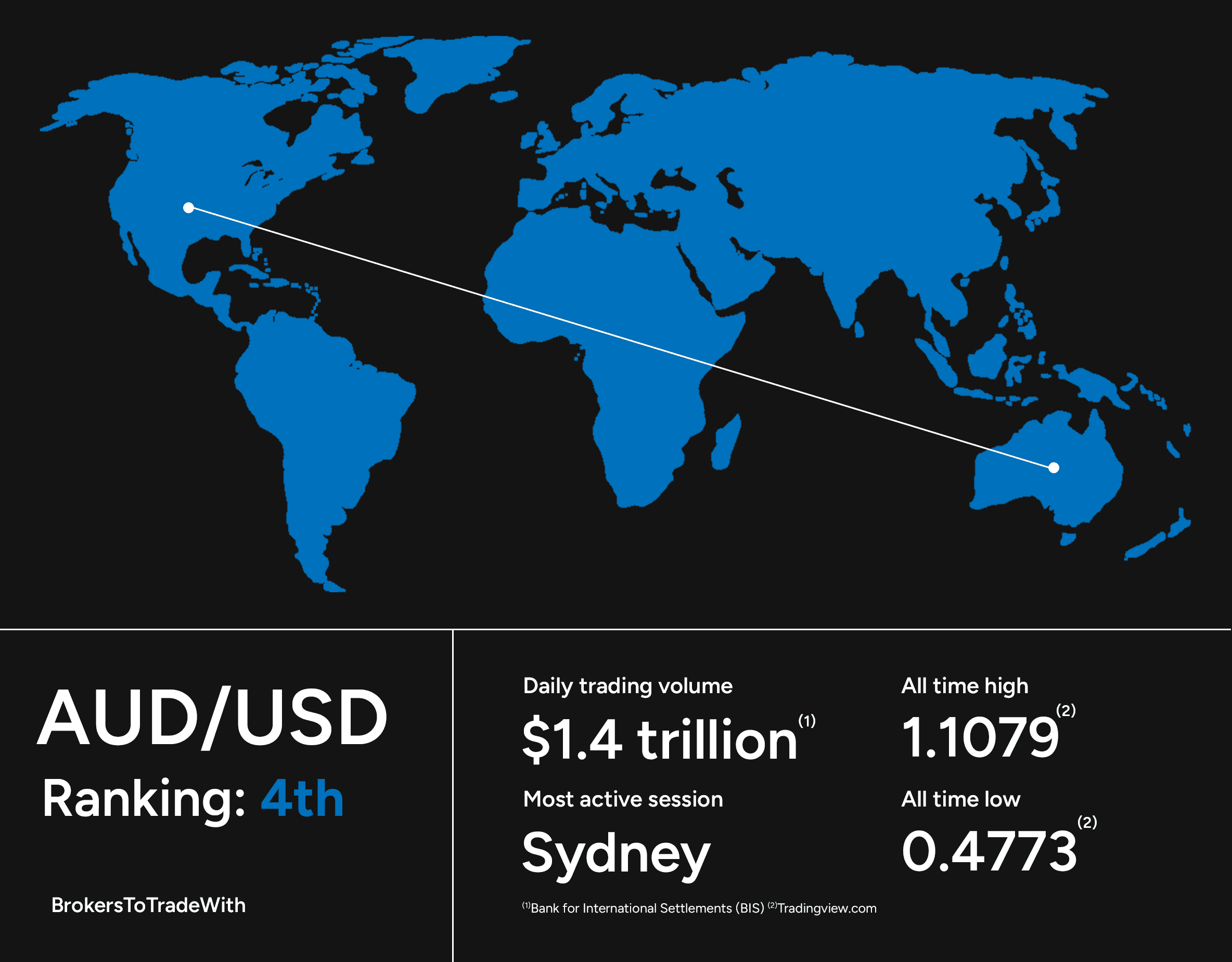

4. AUD/USD

Despite their respective countries being some 15,000~ kilometers apart, the exchange between Australian and United States dollars is responsible for roughly 7% of total forex market trading volume, at $1.4 trillion¹.

Not only unique geographically, but economically, the performance of the Australian dollar is heavily tied to the performance and value of the country’s exports, most notably gold, iron ore, and coal.

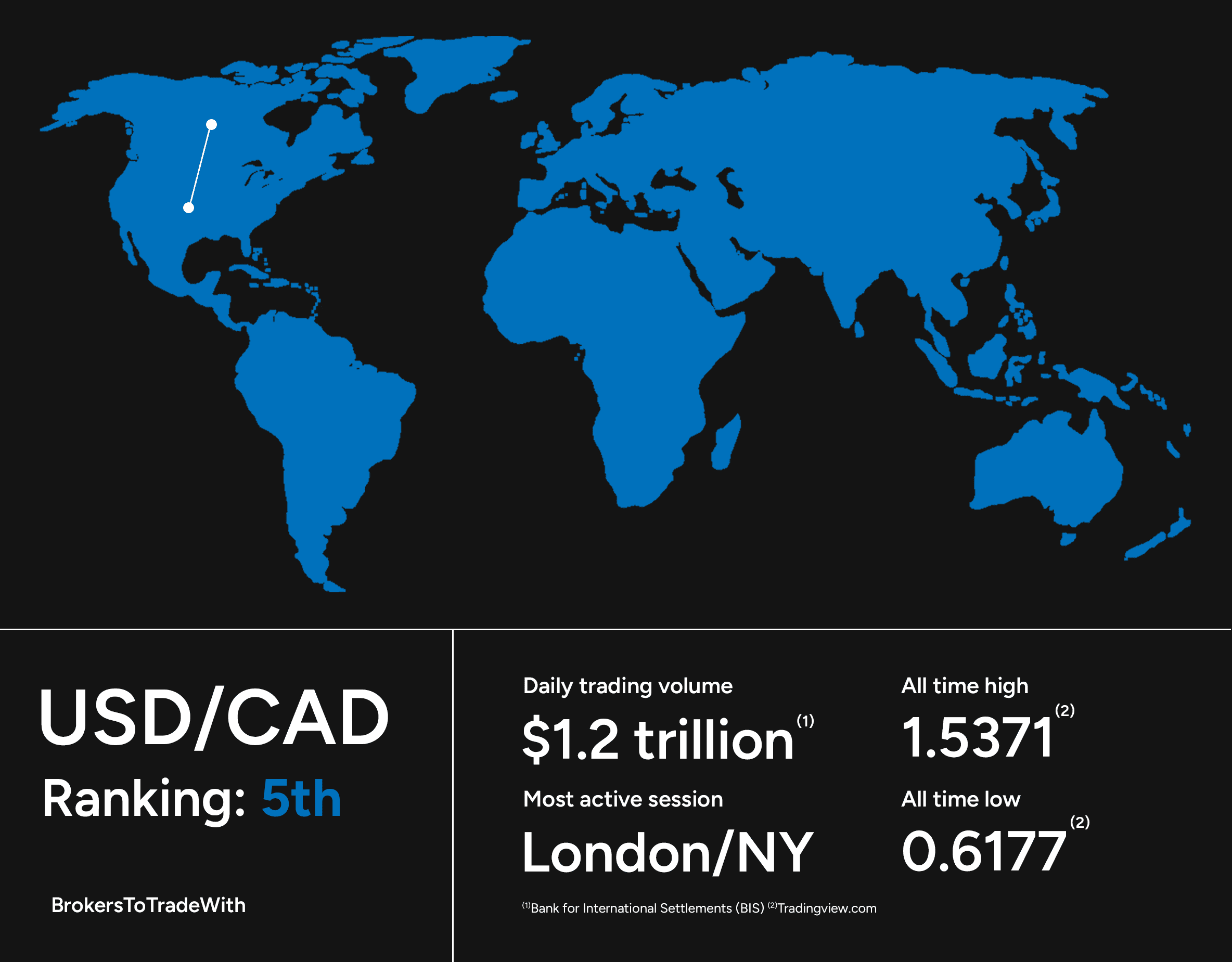

5. USD/CAD

Despite their respective countries being some 15,000~ kilometers apart, the exchange between Australian and United States dollars is responsible for roughly 7% of total forex market trading volume, at $1.4 trillion¹.

Not only unique geographically, but economically, the performance of the Australian dollar is heavily tied to the performance and value of the country’s exports, most notably gold, iron ore, and coal.

Footnotes

⁽¹⁾Bank for International Settlements (BIS) 2022 Triennial Central Bank Survey of Foreign Exchange and OTC Derivatives Markets

⁽²⁾ IMF World Economic Outlook Database, October 2022

⁽³⁾ EIA International Energy Statistics

Disclaimer This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. |

About Us

Your one-stop destination for unbiased, comprehensive, and transparent information on trading brokers.